Owning assets is key. You need capital to own assets, which obviously offer growth and, more importantly, income. It's a positive feedback loop...building more wealth.

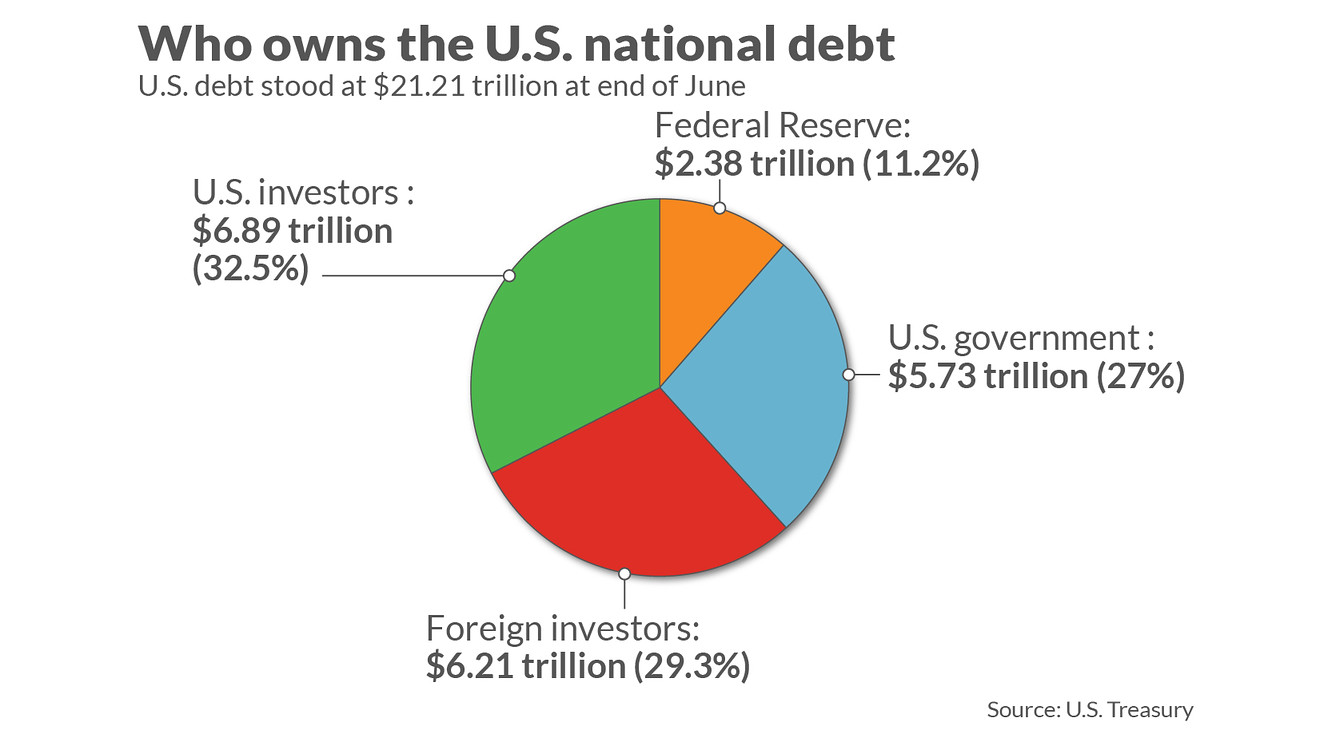

As to that, here is a breakdown of who owns USA debt. I think this upholds my point about skewing distribution of income and wealth. Debt holders are winning.

The ordinary Americans is under pressure, mired in negative cash flow, personal debt, and bleaker job prospects. The best jobs are open to global, mobile, well qualified labor. Consider a $1.7T student loan debt, with many degrees of marginal ROI. Such graduates cannot compete effectively and, ironically, won't do well paying dirty jobs.

The biggest irony: the USA nevertheless remains the greatest wealth producing engine. Again, foreigners know it's better to ride and help us here. Rather than fighting us directly. Why ruin a good thing?

We lack the political and cultural will to turn things around decisively. Too deep in partisan and identity politics. We will never again I think be united as we once were. We'll be a sophisticated dynamic of parallel societies...with the S&P500 continuing to produce 9% CAGR on an economy that is %20+ of global GDP.

For all my ranting, my main point: acquire those assets. I've done this over a lifetime and am well situated. My kids are investing in HS. They will need it compete with global labor and the AI bots. They know assets means the AI works for them.

Just my 2 cents man.

As always, God bless my beautiful America. We've got some work to set things to right.